NTUC Income (Income) has launched Pinfare, a travel-inspired lifestyle insurance by Digital Income, the company’s in-house Digital Transformation Office (DTO).

NTUC Income (Income) has launched Pinfare, a travel-inspired lifestyle insurance by Digital Income, the company’s in-house Digital Transformation Office (DTO).

Pinfare seeks to address one of the most common traveller’s pain points – the pressure of having to purchase a desired flight itinerary on the spot, or be subjected to unpredictable price fluctuations and pay a higher fare on the same flight itinerary later.

With Pinfare, Income transcends its traditional travel insurance offering and caters to an evolving lifestyle that demands flexibility, value and choice.

According to Skyscanner, Singaporeans can lose out on as much as 15% to 31% savings in air travel as they often book flights at the last minute. By offering price assurance while allowing time for coordination and decision-making, travellers now have greater flexibility in planning travel schedules with their families and friends, without losing out on value.

Mr Peter Tay, Income’s Chief Operating Officer, who heads the DTO, said: “Singaporeans are one of the most travelled citizens in the world. This prompts us to assess the customer journey, starting from when travellers begin to plan their journey, to determine opportunities where we can improve their experience with insurance offerings and services. As one of the leading travel insurers in Singapore, we are excited to have reimagined traditional travel insurance with Pinfare to offer our customers peace of mind even before they embark on their travels.

Added Hugh Aitken, Skyscanner’s Senior Director Strategic Partnerships: “The traveller is at the heart of everything that we do at Skyscanner. Through our proprietary technology and products, we strive to make travel search simple. We are excited to announce our latest partnership with Income. Pinfare, powered by Skyscanner, allows travellers to be more flexible with their planning and booking without losing out on value or choice. This is a great example of how Skyscanner works collaboratively with global partners to offer the best solutions for travellers so they have more time to enjoy their next adventure.”

Pinfare protects travellers when prices of their pinned itineraries increase

Understanding that travellers tend to compare and shortlist preferred flight itineraries and airfares before making a decision to purchase, Pinfare allows a traveller to pin up to three sets of preferred flight itineraries at their respective prices on its platform.

Powered by Skyscanner, Pinfare provides real-time flight itineraries and prices every time when a traveller searches the platform to pin flights.

Once pinned, the flight itineraries are insured by Pinfare for seven days and the traveller is protected should the price of any of the pinned itineraries increases at the point of purchase within the insured period. When this happens, an insurance claim can be made.

To be eligible for Pinfare, the traveller must purchase the policy at least three weeks from the flight departure date to mitigate against the probability that airfares increase nearer to the departure date.

Pinfare’s premiums, which start as low as $5, will vary according to variables such as the number of pinned flight itineraries, proximity to departure date, travel destination and dates, choice of airlines and flight class, as well as, departure timings. This means that travellers, who purchase Pinfare closer to their intended departure date, or have chosen peak holiday season to travel, are likely to pay a higher premium.

For now, Pinfare insures economy flights to six countries including Malaysia, Indonesia, Thailand, Vietnam, Philippines and Hong Kong, and will extend coverage to more countries by the end of 2019.

Pinfare supports seamless purchase of pinned flight itinerary directly from the airlines

When insured by Pinfare, the traveller receives a daily update on the price of each pinned flight itinerary via email so that no one is left out on a good deal. To ensure that the traveller purchases the pinned flight itinerary, Pinfare links the traveller directly to airline websites from its platform seamlessly so as to mitigate the potential of the traveller selecting and purchasing a flight itinerary that is different from the pinned and insured one. Purchasing a flight itinerary that is identical to the pinned one, albeit at a different price, is essential for claim validity.

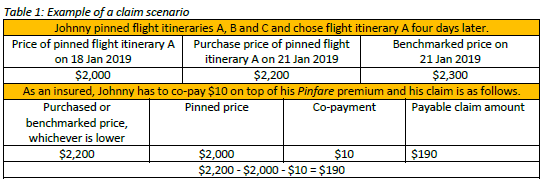

Pinfare bases claims on its 7-Day Flight Price Index, subject to $10 co-payment

The Pinfare 7-Day Flight Price Index is the benchmarked price which claims are based on in the event of unexpected price surge and the pinned itinerary is purchased at a higher airfare than the Index. The latter is defined as the lowest price of each pinned flight itinerary daily as stipulated by Skyscanner during the coverage period, plus 10%.

Typically, a traveller’s claim falls within the Index and can claim the price difference between the purchase and pinned price of the chosen flight itinerary, subject to a $10 co-payment.

Pinfare supports e-claim via PayNow

Designed to offer travellers a seamless digital journey from purchase to claim, those insured by Pinfare can make an e-claim by submitting the confirmed flight itinerary, original receipt which states the breakdown of costs and proof of identity for validation on the Pinfare website.

While the traveller has up to twenty-one days to make a claim from the date of the policy purchase, a pay-out via PayNow can be expected within three business days from the day of a claim submission.

Income addresses consumers’ pain point by reimagining insurance

The DTO was set up in 2016 to hot-house digitalisation and innovation at Income. In 2018, Income was named overall first in Singapore, beating 24 other insurers, in the country’s first benchmark3 that measures the effectiveness of insurers’ innovations and digitalisations in three categories – online, social and innovation.

Pinfare is the latest addition to Income’s insurance offerings that caters to customers’ lifestyle needs. It follows closely the footsteps of Droplet, Singapore’s first “rainsurance” to protect consumers against unpredictable surge pricing on ride-hailing platforms (Grab, RYDE and GOJEK) when it rains. For more information on Pinfare, please visit: https://pinfare.sg/

Skyscanner

Skyscanner is the world’s travel search engine, saving travellers’ time and money by finding the best travel options wherever they want to go.

- Founded in 2003, Skyscanner helps more than 80 million people each month to find their travel options

- Skyscanner is available in 30 languages

- Skyscanner’s highly-rated free mobile app has been downloaded 80 million times

- Skyscanner employs over 1200 staff and has eleven offices across the world: Barcelona, Beijing, Budapest, Edinburgh, Glasgow, London, Miami, Palo Alto, Shenzhen, Singapore and Sofia

- Skyscanner is part of the Ctrip group

For more information, please visit www.skyscanner.com.sg

Income

Income was established in 1970 to provide affordable insurance for workers in Singapore. Today, two million people in Singapore look to Income for trusted advice and solutions when making their most important financial decisions. Its wide network of advisers and partners provide life, health and general insurance products and services to serve the protection, savings and investment needs of customers across all segments of society.

Right from the start, Income was made different. Its social purpose of maximising value for our policyholders defines us as a social enterprise as we continue to make insurance accessible, affordable and sustainable for all.

In 2017, Income had over $36.3 billion in assets under management. Its financial strength and diversified investment portfolio is reflected by our strong credit ratings which underpin the delivery of our commitment to customers.

Income’s corporate social responsibility initiative, OrangeAid, is committed to empower a better future for children and youth from disadvantaged backgrounds.

For more about Income, please visit www.income.com.sg