SINGAPORE, 8 November 2018: Bullionist Technology, a Singapore fintech company, announced that it has developed ELUME, a digital platform on the IBM Blockchain Platform and targeted at the bullion market supply chain. The platform aims to promote transparency, authenticity and true ownership of bullion assets through the use of blockchain technology.

SINGAPORE, 8 November 2018: Bullionist Technology, a Singapore fintech company, announced that it has developed ELUME, a digital platform on the IBM Blockchain Platform and targeted at the bullion market supply chain. The platform aims to promote transparency, authenticity and true ownership of bullion assets through the use of blockchain technology.

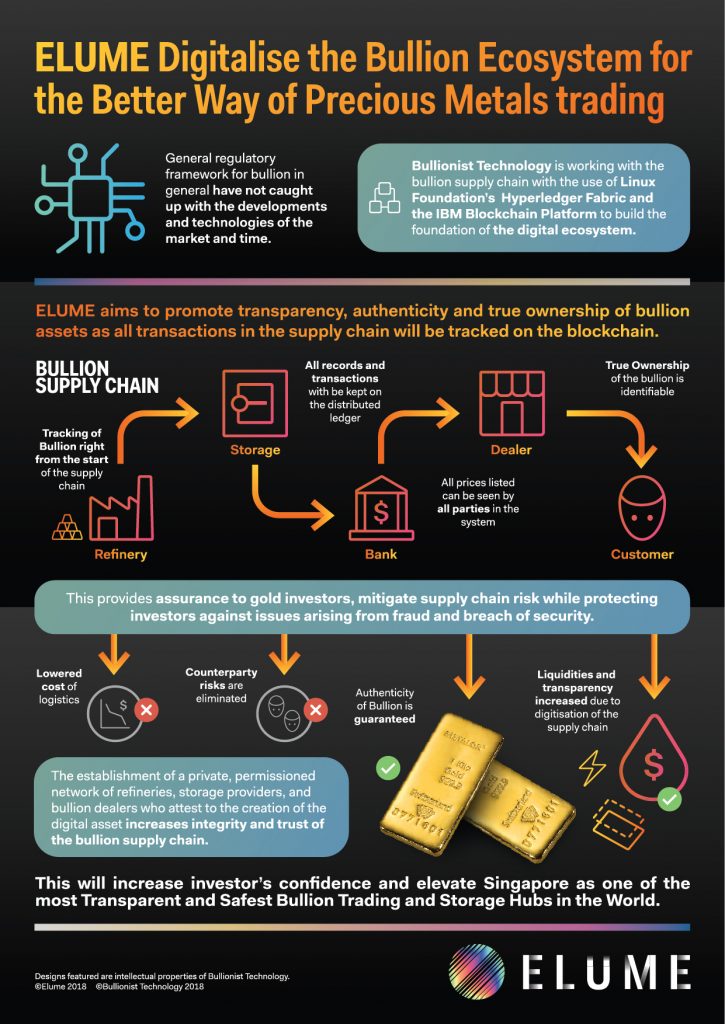

The lifecycle of the bullion assets and related transactions in the supply chain will be tracked on the blockchain, which provides assurance to investors, and mitigates supply chain risk while protecting against issues arising from fraud and breach of security.

ElumeGold (EAU) is the unit of physical gold trades in the digitized supply chain and each unit represents the ownership of physical gold. EAU is NOT a cryptocurrency. EAUs have corresponding amounts of physical gold and those are kept in the designated vault, and gold is redeemable upon requests. The following are the details of EAU:

* 1 EAU represents 1 gram of the London Bullion Market Association (LBMA) accredited refinery’s 999.9 gold.

* 1 EAU can be broken down into a minimum of 0.001 EAU.

* EAU prices are quoted in USD per 1 EAU.

* All the trade information including ownership transfer will be recorded on the distributed ledger.

* The corresponding amount of physical gold bars will be kept in the authorized vault and audited regularly.

* 1,000 EAUs are redeemable to 1 kg physical gold.

Mr Hidetaka Namiki, Chief Executive Officer of Bullionist Technology Pte Ld, said: “The objective of ELUME is to transform the existing eco-system into a digitalised eco-system. ELUME will be an interactive electronic trade matching and record keeping platform to connect all supply chain members – refineries, logistics, bullion banks, bullion dealers, etc. under blockchain technology.”

ELUME is unique for the level of integrity and transparency it offers while preserving privacy of asset ownership and related trade transactions. Care is taken to ensure that trades only occur between counter-parties that have been pre-screened. ELUME uses the IBM Blockchain Platform powered by Hyperledger Fabric on the IBM Cloud to build the foundation of the digitised supply chain. In addition, the platform caters to interactions with supporting digital trading networks to facilitate atomic exchange of asset ownership between members.

Mr Alan Lim, Asia Pacific Practice Leader – Blockchain Lab Services & Garage, IBM, said: “The bullion supply chain is very complex and requires integrity, confidentiality and auditability. Representing real world bullion assets digitally enables them to be traded easily with reduced friction. Meanwhile, the establishment of a permissioned network of refineries, storage providers and bullion dealers is important to increase trust and transparency in the bullion ecosystem.

The IBM Blockchain Platform delivers unique network capabilities such as enhanced security and confidentiality, efficient processing, scalability, standard programming languages and a modular structure that can be customised for further deployments.

“ELUME will improve transparency of the bullion market including true ownership of gold and traceabililty of all trade details including ownership transfer as those recorded in the blockchain. All transactions under ELUME platform and eco-system will be secured including instant transfer of ownership. There will also be improved settlement procedures.

ELUME will revolutionise the bullion settlement infrastructure. It will also develop new markets such as to facilitate lending and borrowing for investors against their underlying bullion assets. This will help increase market liquidity,” added Mr Namiki.

ELUME will facilitate stronger digital collaboration across the multiple parties involved in the bullion supply chain, improve the efficiency of transactions, and promote transparency among participants.

Furthermore, it is envisioned that the platform will support regulated financial institutions as well as regulators such as Customs or other government agencies with anti-money laundering, counter-terrorist financing and cross-border commercial crimes prevention initiatives. This will increase investors’ confidence and bolster Singapore as a precious metal trading hub.