Developers posted sluggish new private home sales in December, transacting just 170 units (ex. Executive Condos) – the lowest monthly home sales tally since January 2009 where 108 units were sold. On a month-on-month basis, December’s sales were down by 34.6% from the 260 units shifted in November. Meanwhile, sales fell by nearly 74% year-on-year when compared to the 650 units transacted in December 2021.

The pullback in sales could be attributed largely to the lack of major private residential project launches during the month and the year-end seasonal lull. On the other hand, sales of ECs – a public-private housing hybrid – were boosted with the successful launch of Tenet EC in Tampines in December. Developers sold 468 new ECs in December, up from 186 units moved in November. The 618-unit Tenet EC sold 451 units at a median price of $1,381 psf – accounting for about 96% of EC sales in December.

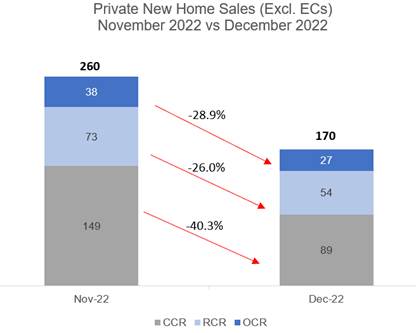

For the third consecutive month, new home sales volumes fell month-on-month across the board in the three sub-markets. The Core Central Region (CCR) accounted for about 52% of the monthly sales, transacting 89 units – down from 149 units in the previous month. Leedon Green was the best-selling CCR project in December, with 11 transactions at a median price of $2,886 psf.

In the Rest of Central Region (RCR), developers sold 54 new private homes in December, representing a 26% fall from 73 units transacted in the previous month. The Landmark and Riviere came out as the top-selling projects for the month, shifting 14 units each at a median price of $2,590 psf and $2,978 psf respectively.

In the Rest of Central Region (RCR), developers sold 54 new private homes in December, representing a 26% fall from 73 units transacted in the previous month. The Landmark and Riviere came out as the top-selling projects for the month, shifting 14 units each at a median price of $2,590 psf and $2,978 psf respectively.

Meanwhile, sales (ex. EC) in the Outside Central Region (OCR) remained lacklustre in December. Buyers picked up a total of 27 new homes from eight projects amid the dwindling unsold inventory in this sub-market. Based on the new sales data released by the URA, 25 out of the 37 existing OCR new launches (ex. EC) are either fully sold or more than 90% sold. The limited unsold stock is a key factor that has weighed on OCR sales in recent months.

Developers placed 45 new units (ex. ECs) for sale in December – down from 319 units that were put on the market in the previous month. This is possibly the lowest number of launched units in a month in more than 10 years. Meanwhile, the EC market saw an injection of 618 new units with the launch of Tenet during the month.

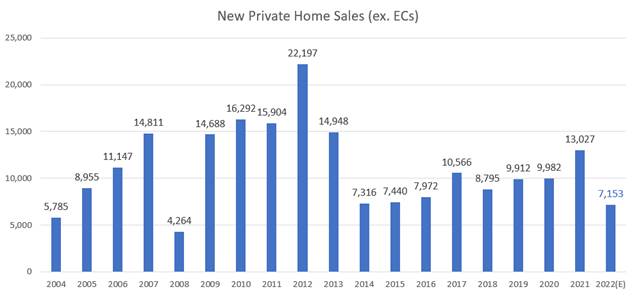

Said Ms Wong Siew Ying, Head of Research & Content, PropNex Realty: “Taking in December’s sales, developers sold an estimated 7,153 new private homes (ex. EC) in 2022, sharply down from the robust sales of 13,027 in 2021. Based on the transaction data, this would be the lowest annual new home sales since 2008 (see Chart 1). That being said, given the year that we have had in 2022, with a cocktail of challenges – from recession concerns to rising interest rates to high inflation – and a fresh bout of cooling measures in September, we think the new homes sales upwards of 7,100 units are quite decent.

While December’s sales of 170 units (ex. EC) seem relatively dismal, we think it is largely a function of the lack of major launches during the month, as well as the depleted unsold stock, particularly in the RCR and OCR where the bulk of the owner-occupied and HDB upgrader demand sit. Meanwhile, revenge travel post-pandemic could also have taken buyers out of the market.

The fresh cooling measures in September 2022 and high interest rates will influence buying decisions, but we do not think that they have choked housing demand. Many buyers are still in the market for new homes, as evidenced by the positive sales response at Sceneca Residence – which was launched over the weekend. The project in Tanah Merah sold 60% of its 268 units at an average price of $2,072 psf.

Price movements were muted in view of the tepid sales and lack of major new launches. According to URA Realis caveat data, the transacted median unit price for the CCR and OCR had fallen slightly by 1.4% and 1.2% respectively from November to December, while that of RCR strengthened by 5.5% MOM (see Table 1).

Over in the EC market, the brisk sales at Tenet EC in December, and the sold-out Copen Grand EC meant that the unsold supply of new ECs remains limited. Prospective EC buyers can look at North Gaia, where there is still an ample number of units, or may opt to wait for the next new EC launch in Bukit Batok West, which could potentially come on towards the later part of 2023.

Over in the EC market, the brisk sales at Tenet EC in December, and the sold-out Copen Grand EC meant that the unsold supply of new ECs remains limited. Prospective EC buyers can look at North Gaia, where there is still an ample number of units, or may opt to wait for the next new EC launch in Bukit Batok West, which could potentially come on towards the later part of 2023.

The daily 3-Month Compounded SORA (Singapore Overnight Rate Average) has shown signs of slowing over the past weeks.

It dipped to 2.9980% p.a. on 9 January 2023 and is at 3.0298% p.a. as at 16 January, compared to the recent high of 3.1415% p.a. on 27 December 2022. Although interest rates will likely remain elevated in 2023, hopes of a slower pace of growth and the possibility of a fall in rates in 2024 could encourage some buyers to enter the market to buy new homes this year – as opposed to waiting for interest rates to drop, which may spark a surge in housing demand at that time.”